GTA Real Estate Market Highlights of 2024 and Predictions for 2025

Written by Becky Brinn

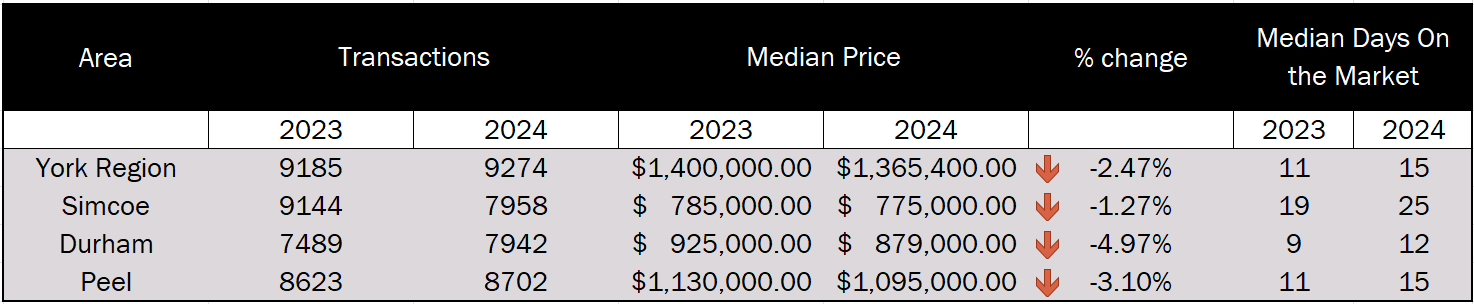

While the number of single-family homes sold across the GTA increased in 2024, so did the number of listings, putting downward pressure on prices. Here are the key highlights that impacted sales and prices in 2024:

GTA Condo Market Dips

Rising supply from newly completed condo projects, coupled with high borrowing costs, changes to the International Student Program, and the foreign buyer's ban, pushed average sales prices down.

Investors pulled back due to diminished returns, adding to the downward pressure on condo prices.

Return to a Balanced Market

Increased listings and a cooling of buyer activity resulted in higher days on the market and more months of inventory across the GTA.

Buyers gained more choice and negotiating power, frequently rejecting the “offer date” strategy by waiting for deadlines to pass rather than engaging in competitive bidding wars.

Five Rate Cuts

The Bank of Canada implemented five rate cuts in 2024, bringing the overnight lending rate from 5% to 3.25%.

The effects of these changes have been slow to materialize as affordability, U.S. policy decisions, and economic concerns continued to impact buyer confidence.

A shift is expected in 2025 as lower interest rates and lending policy changes may encourage more buyers to enter the market.

Stress Test Changes

Stress tests are no longer required when switching a conventional (uninsured) mortgage to a new lender at renewal.

This is welcome news for over 1 million families renewing their mortgages in 2025, giving them more flexibility to shop for better rates.

Lending Policy Changes

New policies effective December 15th have provided benefits for first-time home buyers (FTHB) and insured mortgage holders:

Increased amortization periods for FTHBs and preconstruction homes from 25 to 30 years.

The borrowing limit for insured mortgages rose from $1 million to $1.5 million, primarily benefiting buyers in the GTA where median home prices exceed $1 million.

Market Trends in 2024

Many buyers, particularly first-time home buyers, stayed on the sidelines in 2024, potentially waiting for further rate cuts.

Home prices fluctuated throughout the year, with the GTA finishing 2024 down 1.6% year-over-year.

Bright spots in the GTA included areas like King, Essa, Adjala-Tosorontio, and Innisfil, which saw modest increases in single-family home prices.

What’s Ahead in 2025?

January is typically a slow month, but new listings are already growing daily. Homes that lingered on the market for months are suddenly selling and in York Region, listings are up about 15% compared to December. Depending on how the headwinds impact the overall economy here is how the market would typically respond;

Single-Family Homes: The cumulative effect of rate cuts, lending policy changes, and sliding home prices is expected to fuel an active and potentially early spring market. Single-family home prices are likely to edge higher through May and June.

Condo Market: Investors remain cautious, and more condo tower completions will continue adding inventory. Prices are expected to decline further through 2025.

Challenges Ahead

Political and economic uncertainty—both federally and provincially, as well as in the U.S.—could create headwinds for the real estate market. Inflationary pressures and broader economic trends will likely influence market activity.

2025 is shaping up to be a dynamic year for the GTA real estate market, with single-family homes poised for growth and the condo market facing ongoing challenges. It will be interesting to see how these trends unfold!

If you’re planning to buy, sell, or simply want to better understand how these market influences impact you, I’m here to help. Contact me today for personalized advice and strategies to navigate the changing real estate landscape!